What the long-term implications of this chaos will be, remain to be seen. The day traders of Reddit will have been buoyed by their remarkable successes, even if they were followed by some stories of very burned fingers as the market fought back hard. So we can expect ‘wallstreetbets’ to continue to have an impact in the short term at the very least.

This means that the financial markets will be volatile and that unpredictability will put off a lot of investors who don’t want to be collateral victims in the middle of this battle between the establishment and Redditors.

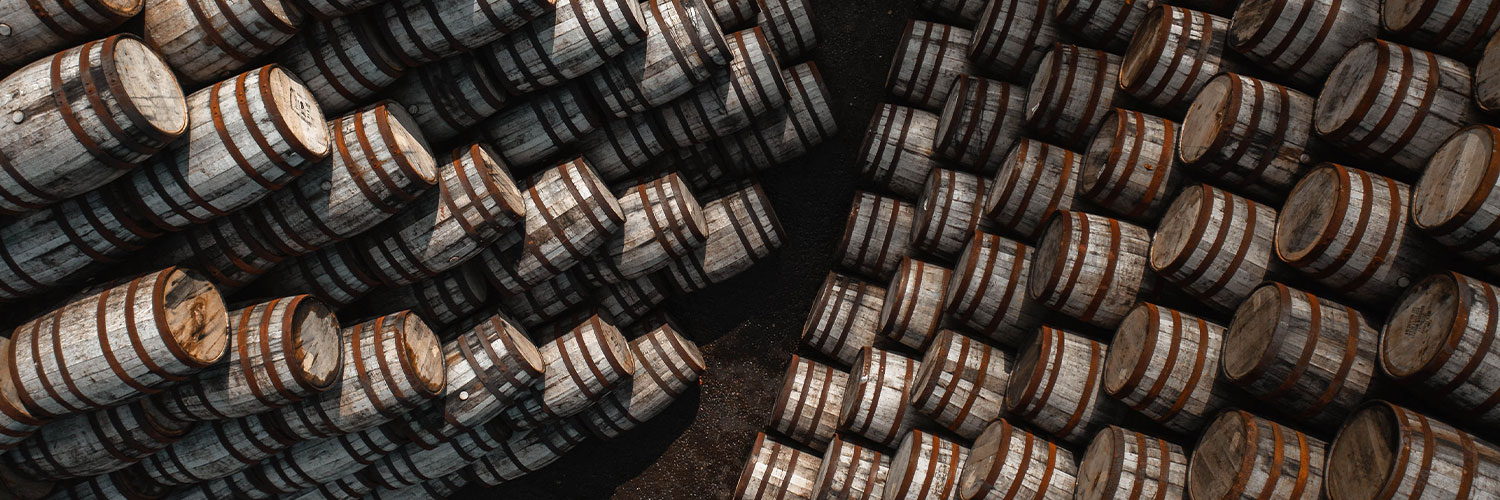

In such times of uncertainty, wise investors traditionally turn to assets to spend their money on, knowing that these offer less risk of being impacted by fluctuations in the markets. Assets like Scotch whisky have shown that they can ride out such storms and continue to offer value for money.

In 2020, Covid-19 did have some impacts on whisky production and distribution, but these were short-term and the value has been largely unaffected. This is down to the nature of whisky investments and production. If you’re investing in a 70-year-old bottle of Scotch, its value isn’t going to be affected by lockdown or people from Reddit trying to prank the stock markets.

There’s only finite supplies of each kind of whisky, especially vintage bottles and casks and it’s never going to go out of fashion or be impacted by changing habits. Indeed, whisky produced in 2020 may well benefit in value by the fact that production of it was largely halted for months, so there may be less of it available than other years.

With rare whisky already having risen in value by over 500% between 2010 and 2020, it’s proving itself to be a highly profitable alternative investment during a pandemic and there’s every reason to believe that it will continue to be a safe and lucrative port in a storm during the market volatility of 2021.